Unlock the secrets to buying your dream property in Italy with our comprehensive guide. Designed specifically for digital nomads and remote workers, our detailed FAQ provides all the answers you need. Start your journey today and make your Italian property dream a reality!

1. Can a foreigner buy property in Italy?

Yes, foreigners are allowed to buy property in Italy. The country welcomes international investors, including digital nomads, to purchase residential and commercial properties. However, certain reciprocal agreements may apply to non-EU citizens, depending on their home country's policies. Always check the specific requirements with a legal expert in Italian real estate.

2. What are the steps to buying property in Italy?

Here’s a detailed step-by-step guide for buying property in Italy as a digital nomad:

- Research the Market: Investigate regions, property types, and market trends. Platforms like Immobiliare.it and Idealista can help you explore listings.

- Choose Your Location: Consider factors like connectivity, lifestyle, and cost of living. Popular regions include Tuscany for its charm and Milan for its urban vibe.

- Set Your Budget: Factor in additional costs like taxes (usually 2-10% of the purchase price), legal fees, notary fees, and property maintenance.

- Engage Professionals: Hire a bilingual real estate agent, lawyer, and notary familiar with Italian property transactions.

- Property Inspections: Conduct thorough property viewings or virtual tours. Check for structural issues and ensure legal documentation is in order.

- Sign a Preliminary Agreement (Compromesso): This binding contract outlines the terms of the sale. You will typically pay a deposit of 10-30% at this stage.

- Due Diligence: Ensure all property taxes and permits are up to date. Your lawyer will verify this during the process.

- Finalize the Sale (Rogito): Sign the final contract in the presence of a notary, after which ownership is officially transferred.

3. What are the additional costs of buying property in Italy?

When purchasing property in Italy, the following costs are common:

- Property Registration Tax: Ranges from 2% (primary residence) to 9% (secondary residence).

- Notary Fees: Typically 1-2% of the property's value.

- Agent Commission: Usually around 3-5% of the sale price, shared between buyer and seller.

- Legal Fees: Vary depending on the complexity of the transaction, averaging €2,000 to €5,000.

- Mortgage Costs: Include application fees and bank charges if financing is required.

- Renovation Costs: Many older Italian properties require updates, so plan accordingly.

4. Can digital nomads get a mortgage in Italy?

Yes, but obtaining a mortgage as a digital nomad may involve additional scrutiny. Italian banks often require proof of income stability, tax returns, and a minimum down payment of 20-40%. Some banks specialize in offering mortgages to non-residents. It's advisable to work with a mortgage broker familiar with international clients.

5. Do I need a visa to buy property in Italy?

No visa is required to purchase property in Italy. However, if you intend to live there, you need to apply for a visa suitable for your circumstances. The Elective Residence Visa is ideal for retirees or self-sufficient individuals, while the upcoming Digital Nomad Visa is tailored for remote workers.

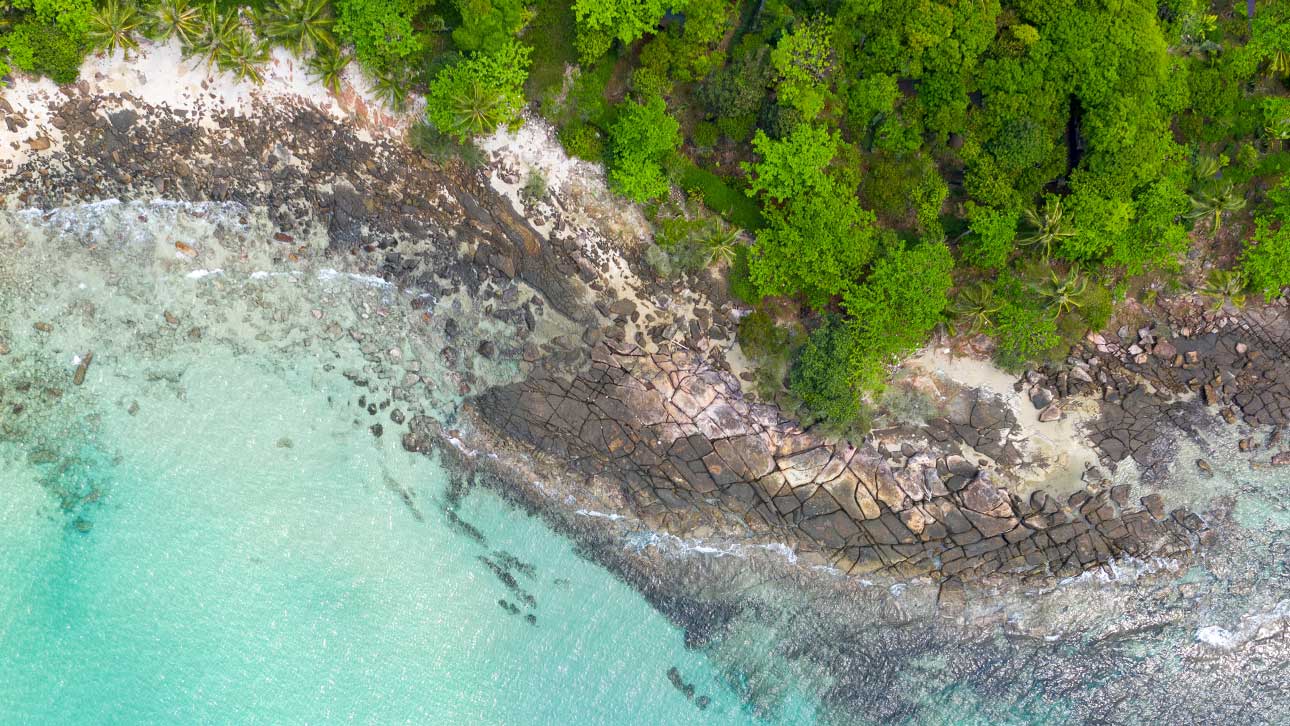

6. What are the best regions in Italy for digital nomads?

Each region in Italy offers unique benefits:

- Tuscany: Famous for rolling hills, vineyards, and a serene lifestyle.

- Milan: A dynamic city with excellent tech opportunities and cultural events.

- Sicily: Affordable living with picturesque landscapes and beaches.

- Rome: History-rich and well-connected for international travel.

- Lake Como: Offers luxury living and tranquility.

- Puglia: Known for its stunning coastline and slower pace of life.

7. How long does it take to buy property in Italy?

The process typically takes 3-6 months. Factors influencing the timeline include due diligence, financing arrangements, and availability of documents. Working with experienced professionals can help expedite the process.

8. Can I rent out my property in Italy?

Yes, you can rent out your property. Italy has thriving short-term rental markets in cities like Florence and Venice. Ensure compliance with tax obligations and local regulations, which may include registering your rental business with the municipality.

9. What should I know about Italian property taxes?

Property taxes in Italy include:

- IMU (Municipal Property Tax): Applicable on secondary residences and luxury homes.

- TASI: Covers local services like street cleaning and lighting.

- Registration and Stamp Duties: Paid during the property transaction.

Taxes vary by region and property type, so consult a tax advisor to understand your obligations.

Did you enjoy this article?

If you love discovering inspiring stories and unique places, download our free app "Travel Inspiration Magazine" from Google Play! No annoying ads. No distractions. Just pure reading pleasure.

📲 Install from Google Play![Български [BG] Български [BG]](/media/mod_languages/images/bg_bg.gif)

![English [EN] English [EN]](/media/mod_languages/images/en_gb.gif)